Our Client Success is our success

What sets us apart isn’t just what we do, it’s how we do it! With tailored expertise and customizable solutions, we unlock the full potential of every each opportunity, driving exceptional results for our clients. Our commercial real estate case studies highlight our deep expertise in investment, DEVELOPMENT, asset management, and more, spanning a WIDE range of asset classes. Discover how we've helped clients achieve their goals, explore our success stories below.

Case Study

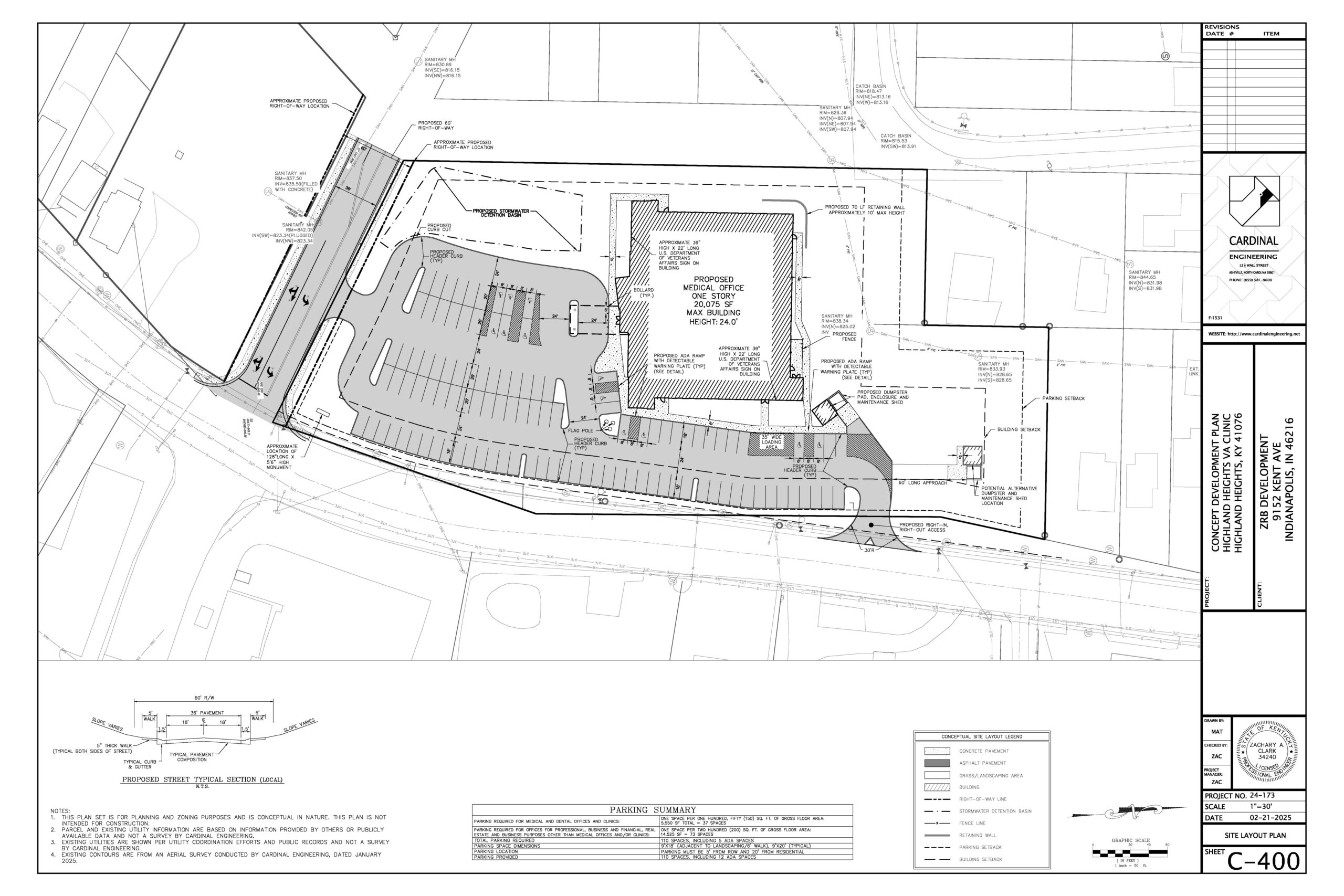

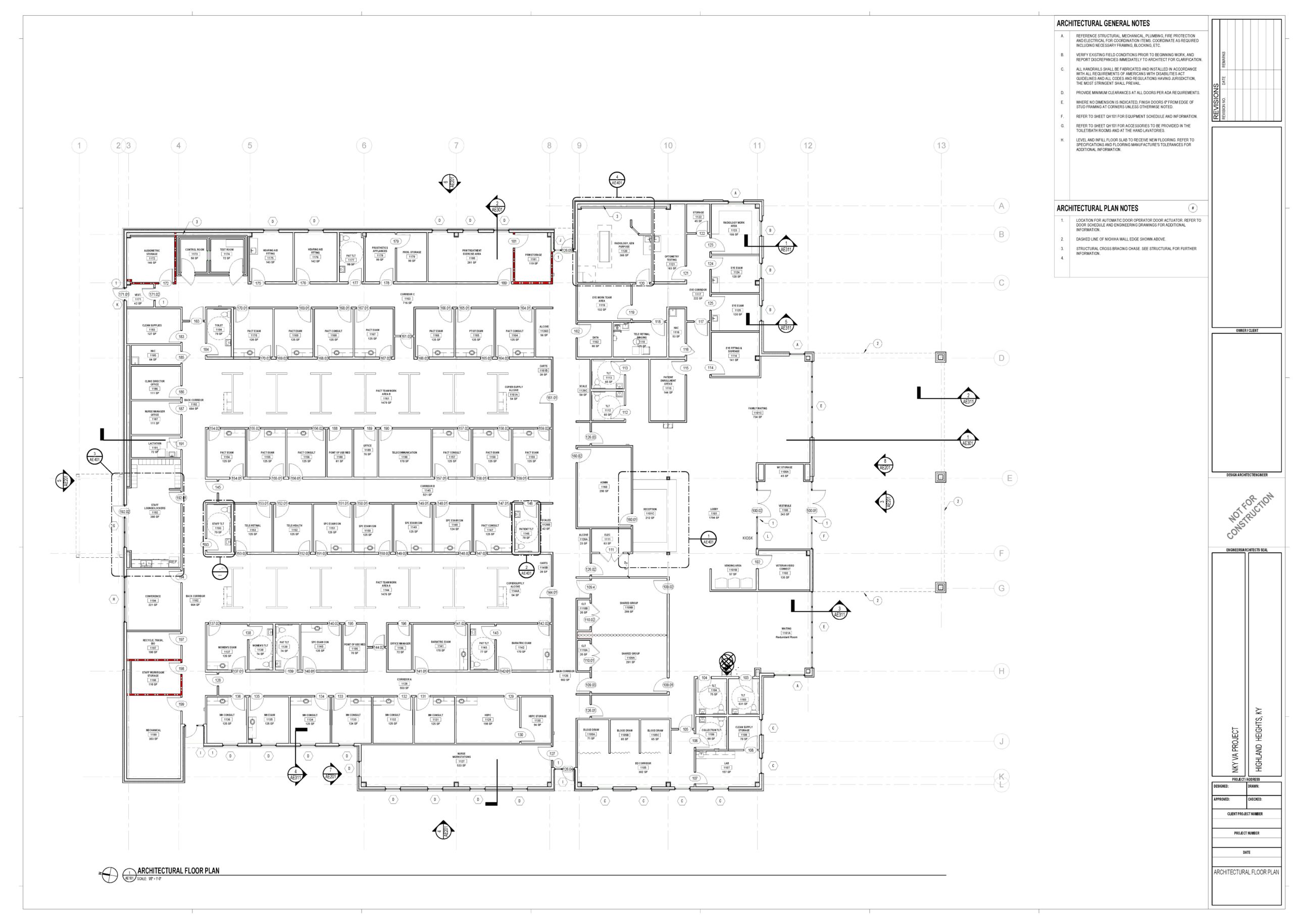

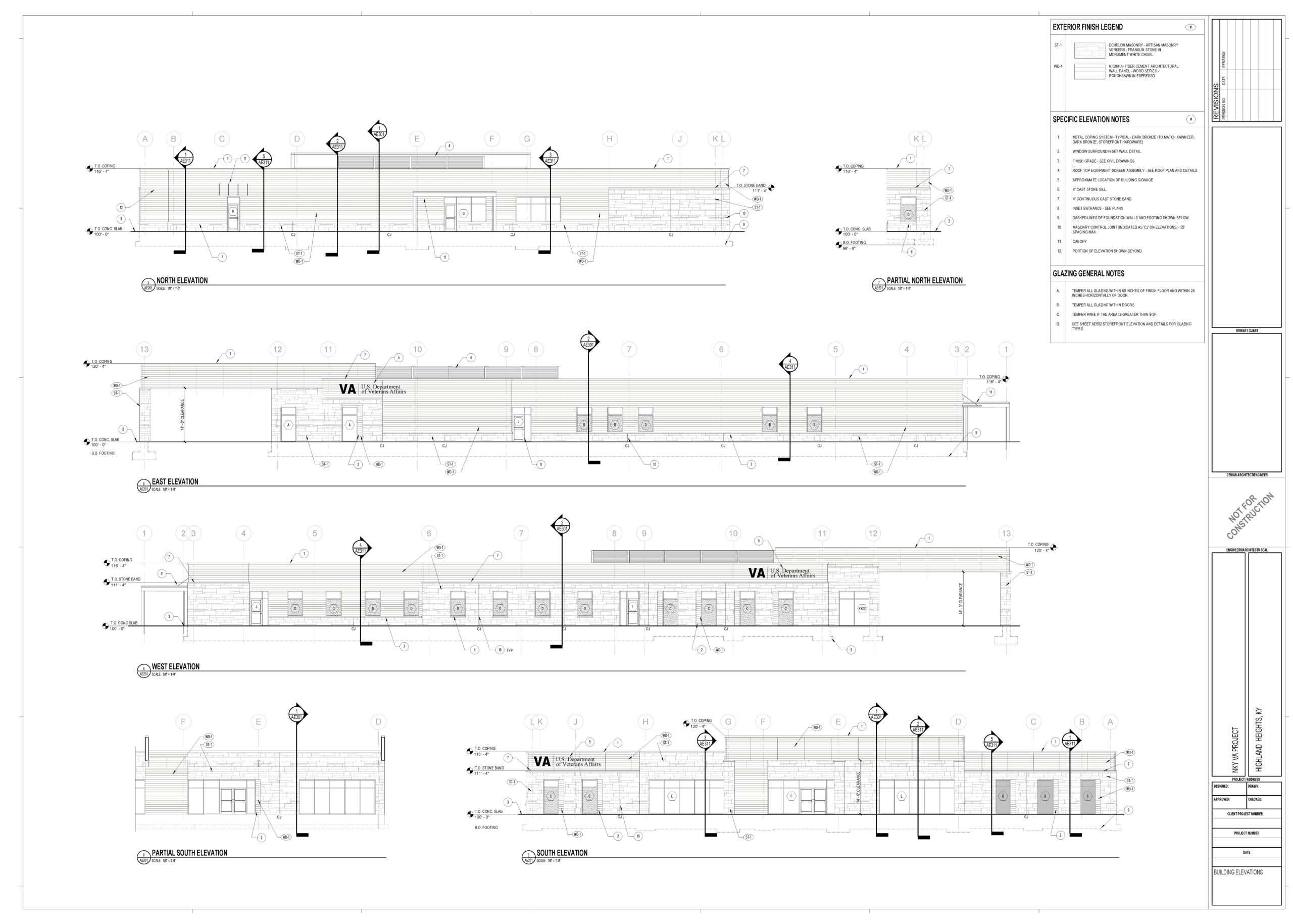

Pursuing the U.S. Department of Veterans Affairs Clinic Opportunity

Overview

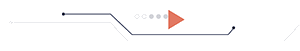

The U.S. Department of Veterans Affairs (VA) released a requirement to lease approximately 20,075 ABOA square feet with 100 parking spaces (16 handicap-accessible) to support a new outpatient clinic in the Bellevue, Kentucky area. The VA will consider a range of solutions, including existing buildings, new construction, multi-tenant facilities, or a build-to-suit option.

CrossPoint – Commercial Real Estate Services identified this solicitation as a strategic opportunity to leverage its expertise in site selection, development management, and government partnerships. To maximize competitiveness and compliance, CrossPoint aligned with a Service Disabled Veteran Owned Small Business (SDVOSB) partner to deliver a veteran-led solution tailored to the Department of Veterans Affairs.

Challenge

The Department of Veterans Affairs’ criteria presented several unique challenges:

Delivering 20,075 ABOA SF that fully complies with the VA’s definition of usable space, excluding non-programmatic areas.

Ensuring 100 dedicated parking spaces, with 16 reserved for disabled veterans and staff.

Identifying sites within Bellevue that balance patient accessibility, traffic flow, and long-term viability despite a tight real estate submarket.

Avoiding disruption to existing VA patient services during development or relocation.

Meeting federal procurement requirements that prioritize veteran-owned businesses.

Solution

CrossPoint developed a comprehensive strategy:

Site Selection: Identified and evaluated viable sites within the VA’s delineated boundaries that meet clinical, accessibility, and parking requirements.

Veteran-Owned Partnership: Formed a development team anchored by an SDVOSB, aligning directly with the VA’s procurement goals while honoring veteran business participation.

Build-to-Suit Model: Structured a turnkey build-to-suit approach to ensure the facility is designed precisely to Department of Veterans Affairs standards.

Public-Private Collaboration: Engaged local officials and infrastructure partners early to streamline zoning, circulation, and utility approvals in support of the VA’s schedule.

Results (Anticipated)

This approach positions CrossPoint and its SDVOSB partner to:

Deliver a custom-built facility that satisfies the VA’s 20,075 ABOA SF requirement and parking criteria.

Enhance the likelihood of award by aligning directly with Department of Veterans Affairs leasing priorities for veteran-owned enterprises.

Secure a long-term federal lease, providing stability for both the VA and the Bellevue community.

Advance regional economic development while ensuring veterans receive high-quality healthcare services in a modern clinic environment.

Conclusion

This case underscores CrossPoint’s ability to identify and pursue federal real estate opportunities, navigate the Department of Veterans Affairs’ stringent requirements, and assemble veteran-led partnerships that honor the mission of serving those who served. By aligning with an SDVOSB, CrossPoint delivers not only a compliant and cost-effective solution, but also one that reflects the values of the VA and the community it serves.

Case Study

STRATEGIC SOLUTIONS FOR U.S. MARKET ENTRY & EXPANSION

Overview

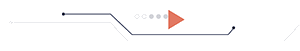

CrossPoint – Commercial Real Estate Services was retained by BWF Envirotec to deliver a build-to-suit North American Headquarters. Serving as a strategic advisor, CrossPoint led economic development negotiations, site selection, and the coordination of design and construction teams for BWF’s new 65,000-square-foot facility.

Challenge

BWF needed to expand into a modern, owned facility while minimizing disruption to its 60+ employees. However, real estate options in the immediate area were limited and financially prohibitive, creating a significant barrier to the company’s growth goals.

Solution

CrossPoint leveraged its deep expertise in site selection and economic incentives to unlock a viable path forward. Through strategic negotiations with state, county, and city stakeholders, CrossPoint secured agreements that enabled BWF to relocate to a neighboring state—transforming a challenging expansion into a financially achievable opportunity.

Results

After months of careful coordination and advocacy, CrossPoint secured a 7.2-acre site at virtually no cost. This outcome laid the foundation for BWF’s new headquarters, with construction scheduled to begin in Summer 2025. In addition, CrossPoint negotiated a comprehensive economic development package, including a tax abatement program, that significantly strengthened the long-term financial outlook for the project.

Conclusion

The BWF Envirotec headquarters project exemplifies the power of strategic advisory and public-private collaboration in commercial real estate development. By overcoming site limitations and aligning economic incentives with corporate goals, CrossPoint delivered a solution that ensures BWF’s continued success in North America. This project not only reinforces workforce stability and operational growth but also highlights CrossPoint’s proven ability to align client objectives with community development priorities—driving economic impact and lasting value.

Case Study

Unlocking Hidden Value Through Our Network

Challenge

In a competitive market with limited availability, our client needed a property that could serve as a new corporate headquarters without disrupting staff operations. They faced the dual challenge of finding a location that aligned with their long-term vision while also making financial sense compared to their existing lease obligations.

Solution

By leveraging the breadth and strength of our network, we unearthed an off-market opportunity that perfectly matched the client’s needs. This property not only satisfied their operational requirements but also offered the chance to transition from leasing to ownership. Our team managed the process from discovery to acquisition, ensuring the client could relocate seamlessly with minimal interruption to business continuity.

Results

Cost Savings: The property was secured at a cost lower than their prior lease, reducing overhead.

Long-Term Value: By moving from tenant to owner, the client gained equity and positioned themselves for long-term financial growth.

Strategic Advantage: The move enhanced control over their future operations, stabilized occupancy costs, and reinforced their corporate identity in a permanent location.

This success highlights the power of our network to identify hidden gems and deliver transformative outcomes, helping clients not just find space, but unlock opportunities that strengthen their financial position and business prospects.

Case Study:

Redeveloping a Public–Private Asset

Challenge

Redeveloping this property required navigating one of the most complex environments in commercial real estate: a transaction involving government entities. Unlike private deals, public–private redevelopment demands balancing competing priorities, working through extensive oversight, and aligning the goals of multiple stakeholders.

In this case, demolition, regulatory approvals, and political considerations all created potential roadblocks. Without the right expertise and relationships, the project could have been delayed indefinitely—or never realized at all.

Solution

Our team leveraged deep experience in public–private partnerships to streamline the process:

Strategic Negotiation: We engaged with government authorities to align policies and approvals with private-sector objectives.

Political Relationships: Trusted connections with decision-makers allowed us to anticipate challenges and move approvals forward efficiently.

Regulatory Expertise: A thorough understanding of the intricate web of checks and balances ensured compliance at every step while keeping momentum intact.

Demolition of existing structures was completed in 2023, paving the way for new development. Construction broke ground in April 2024 following a well-orchestrated approval process.

Results

By bridging the divide between the public and private sectors, we delivered a project that was not only feasible but also completed on schedule:

Stadium largely completed by August 2025—just in time for the new football season.

Successful alignment of public and private interests, ensuring broad community support.

Accelerated timeline despite the inherent complexities of government involvement.

This redevelopment demonstrates the power of expertise, persistence, and collaboration. Without this critical piece of real estate and the partnerships built around it, the project would not have become the transformative success it is today.

Case Study

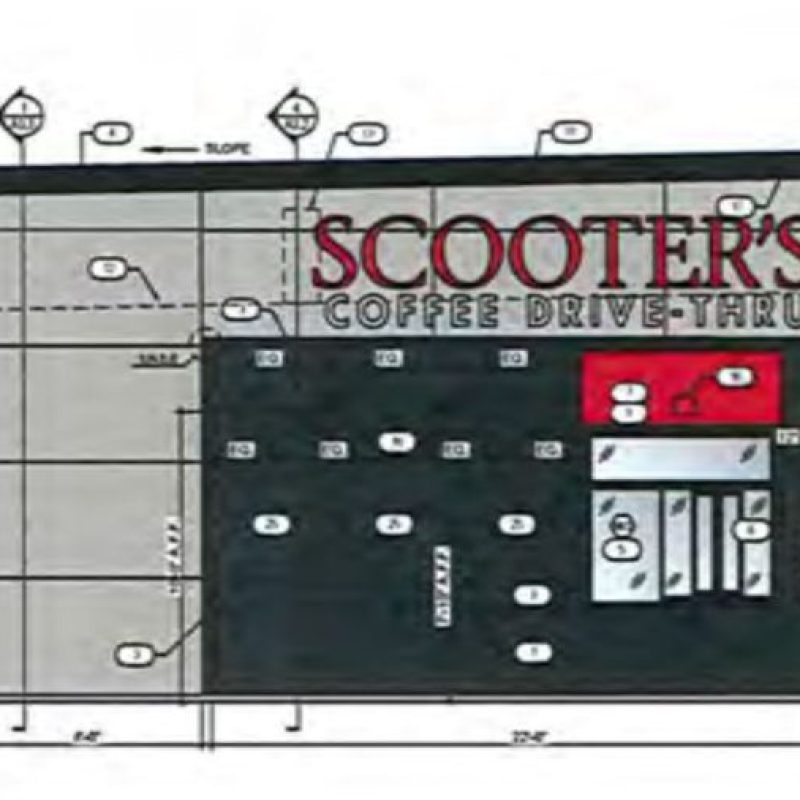

Unlocking Value Through Strategic Outlot Sale

Challenge

The shopping center’s investors were seeking ways to strengthen financial performance and create momentum in their leasing efforts. While the property was stable, optimizing its structure to both generate cash flow and enhance tenant synergy presented a unique opportunity.

Solution

We identified a strategic option: divesting a small outlot within the center. Drawing on our market expertise, we quickly pinpointed a new-to-market coffee retailer as the ideal buyer. Their arrival not only injected fresh energy into the property but also complemented the existing tenant mix, creating a hub of collaboration and daily traffic.

Results

Financial Optimization: The sale generated immediate revenue while significantly reducing the property’s basis. This repositioned the investors for improved ROI and long-term flexibility.

Stronger Tenant Mix: Introducing a first-to-market coffee retailer added vibrancy and broadened customer appeal, benefiting all tenants.

Enhanced Leasing Efforts: The transaction strengthened the center’s positioning, giving ownership a compelling advantage in attracting and retaining tenants.

By aligning financial strategy with tenant synergy, we delivered both immediate and lasting value—turning a single outlot sale into a catalyst for the shopping center’s growth.

Case Study

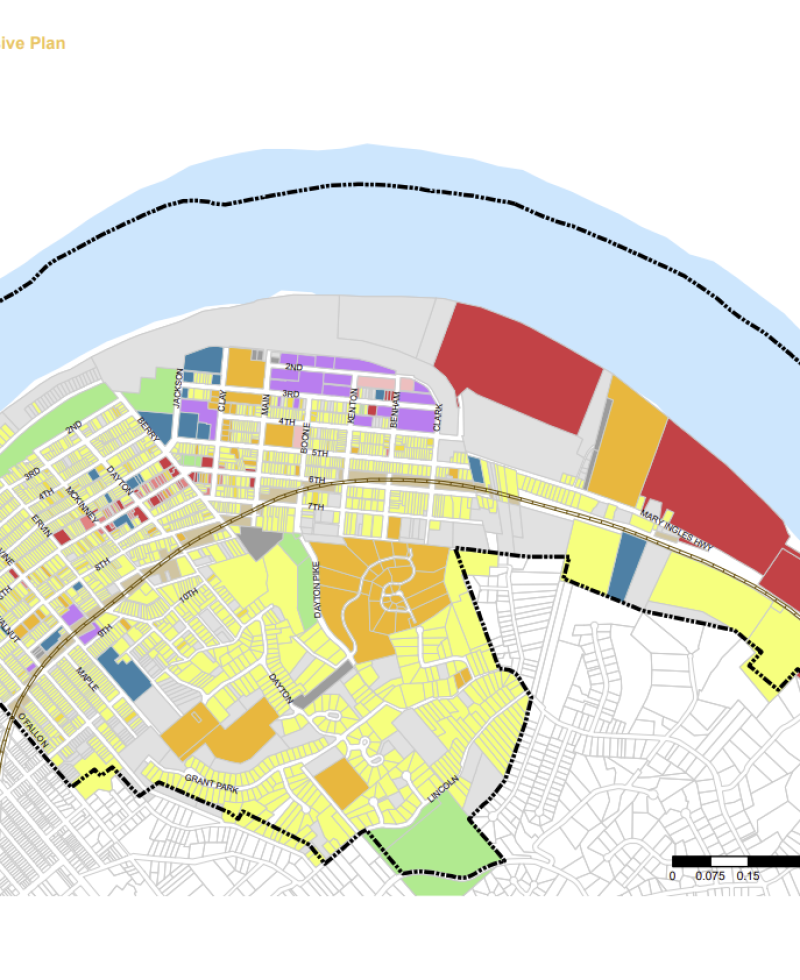

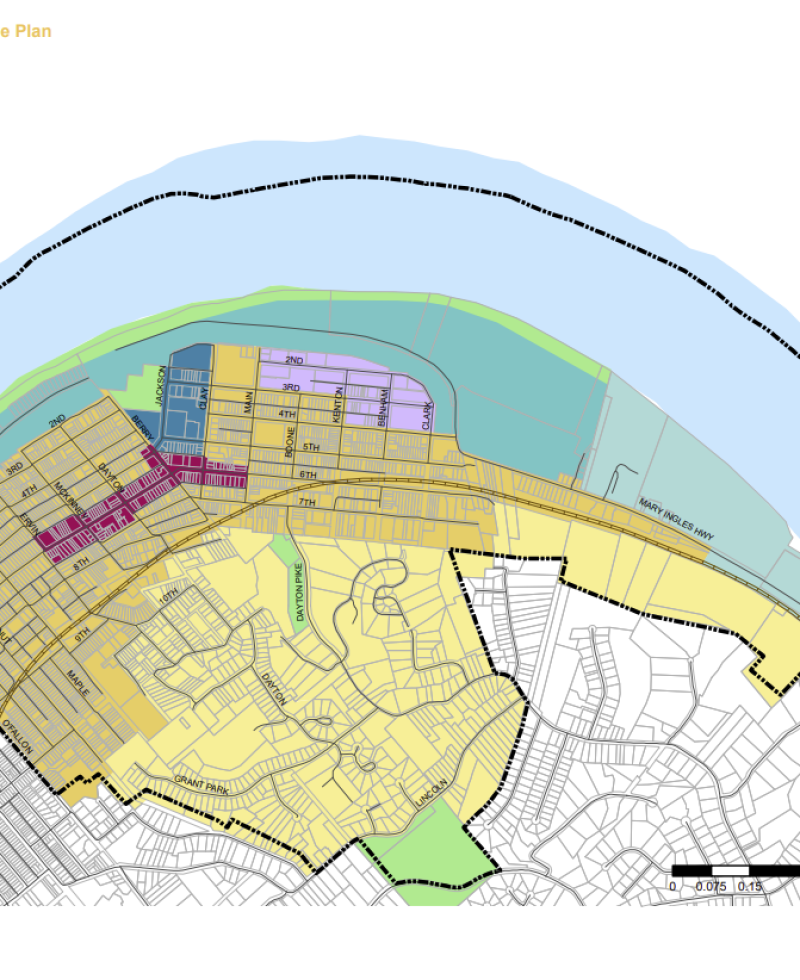

Unlocking Value in Urban Redevelopment

Challenge

The seller owned a property in a competitive urban market, directly adjacent to a $115 million riverfront redevelopment that included a 239-unit apartment building, a 104-room hotel, 21 single-family homes, and 15,500 square feet of office and retail space. While the surrounding investment created tremendous potential, it also raised the stakes. To fully capitalize on the location, the seller needed to reach a buyer who not only recognized the opportunity but had the vision and resources to integrate with this transformative development.

Solution

We leveraged our extensive network, market expertise, and strong relationships to strategically position the property in front of targeted buyers with redevelopment experience. By aligning the property’s unique strengths with the momentum of the riverfront project, we identified a visionary group whose long-term goals fit seamlessly with the asset and its surroundings.

Beyond simply connecting buyer and seller, we structured a transaction that delivered financial advantages and accelerated the path from listing to closing. Our approach ensured the seller maximized value while placing the property with a buyer capable of advancing the broader redevelopment vision.

Results

Maximized Value: The seller achieved a strong return on investment through a competitive transaction.

Strategic Buyer Match: The property was sold to a group aligned with the $115M riverfront redevelopment, enhancing synergies and long-term growth.

Seamless Transaction: Deal structuring streamlined the closing process while minimizing risk.

Community Impact: The sale positioned the asset as a critical piece of a transformative mixed-use corridor, contributing to new housing, hospitality, retail, and office vibrancy along the riverfront.

Conclusion

This success showcases how our network and strategic approach connect sellers with the right buyers, even in competitive environments. By aligning assets with adjacent transformative projects, we unlock hidden value and help property owners play a role in shaping the future of urban development.

Case Study

Sale of a CVS NNN Distribution Center

Challenge

The sellers of a CVS NNN leased distribution center sought to maximize value in a highly competitive investment market. The goal was not only to secure a buyer but also to attract a pool of qualified investors who could recognize the long-term stability and returns associated with this asset.

Strategy

We launched a comprehensive, multi-channel marketing campaign designed to reach an extensive global network of discerning investors actively seeking reliable income-producing opportunities. Leveraging our deep industry expertise, we positioned the distribution center as a premier investment, highlighting its strong tenant, consistent cash flow, and strategic location. The property was presented in a compelling manner that aligned with the objectives of institutional and private capital alike.

Results

Our approach generated significant traction across our investor base, resulting in multiple competitive offers. The heightened demand created a dynamic bidding environment that empowered the sellers with a strong negotiating position. Ultimately, the final transaction exceeded the sellers’ initial expectations, delivering a premium outcome and securing terms that surpassed anticipated value.

Case Study

UC Health Medical Office Building – NNN Investment Sale

Challenge

The Sellers of the UC Health Medical Office Building sought to maximize value and ensure a smooth transaction for their NNN leased property. The goal was to attract highly qualified buyers who would appreciate the long-term stability and exceptional investment fundamentals offered by the asset.

Solution

Through our extensive global network and targeted marketing strategies, we positioned the property as a premier investment opportunity. Our campaign highlighted the unique attributes of the medical office building, including its secure tenant structure, strong credit profile, and predictable cash flow. By strategically tailoring outreach to discerning investors worldwide, we ensured the asset received maximum exposure to the most relevant and qualified buyer pool.

Results

The marketing effort generated significant interest and multiple attractive offers. The competitive environment created a distinct advantage for the Sellers, enabling them to expedite the closing process on terms that exceeded expectations. By leveraging our deep industry knowledge and international reach, we effectively transformed the UC Health Medical Office Building into an irresistible investment opportunity, delivering optimal results and a strong outcome for our client.

Case Study

Marketing the CVS-Leased Distribution Center

Challenge

The sellers sought to maximize the value of their CVS-leased distribution center in a highly competitive investment market. The goal was to position the property as a premier opportunity while reaching the right group of investors willing to recognize its long-term value.

Solution

Our team leveraged extensive market knowledge, global reach, and a targeted marketing strategy to showcase the distribution center’s key attributes, long-term stability, investment-grade tenant, and strong location fundamentals. By carefully identifying and engaging qualified international investors, we created a compelling narrative that highlighted the property’s profitability and durability.

Results

This approach generated significant interest from a broad pool of discerning buyers and resulted in multiple competitive offers. The strong bidding environment gave the sellers a distinct negotiating advantage, ultimately leading to a transaction with terms that exceeded their original expectations and delivered maximum value.

Case Study

Multi-Tenant Office Building Sale

Challenge

The seller sought to maximize value in a competitive market by attracting buyers actively seeking to relocate their corporate offices. The property’s unique strengths, prime location, modern amenities, and potential for collaboration, needed to be effectively communicated to stand out.

Solution

Through our extensive regional network, we launched a targeted marketing campaign that strategically highlighted the property’s key features and benefits. We conducted in-depth market research and analysis, then positioned the building as an ideal opportunity for corporate relocation. By showcasing its state-of-the-art facilities and collaborative environment, we successfully captured the attention of a diverse pool of qualified buyers.

Results

Our efforts generated multiple strong offers, creating a competitive bidding environment that favored the seller. Leveraging our negotiation expertise and deep understanding of market dynamics, we guided the seller through the process and secured terms that exceeded their original expectations.

Case Study

Transforming Office Space into Multifamily Opportunity

Challenge

A conventional office building was underperforming and no longer aligned with the evolving needs of the community. Local investors were seeking a way to maximize the property’s potential while adapting to shifting market dynamics and growing housing demand.

Solution

Through our diligence and market expertise, we identified the property’s untapped value and envisioned a new future for the site. Acting as strategic intermediaries, we guided the investors through a comprehensive analysis and repositioning strategy that transformed the outdated office asset into a vibrant multifamily development. By aligning the project with community trends and market demand, we unlocked the property’s hidden possibilities.

Results

The repositioning created a higher and better use for the site, delivering significantly improved returns for investors. Beyond financial performance, the redevelopment also contributed to meeting community housing needs, turning an underutilized office building into a modern residential asset that adds long-term value to both the investors and the surrounding neighborhood.

Case Study

Sale of CVS Distribution Center

Challenge

The objective was to market a CVS-leased distribution center to a highly discerning pool of international investors. Given the competitive investment landscape, it was essential to create a campaign that not only captured global attention but also emphasized the property’s long-term stability, strong tenant, and market potential.

Solution

Leveraging our global reach and industry expertise, our team executed a comprehensive marketing strategy designed to attract qualified international buyers actively pursuing secure, profitable investments. Through rigorous market analysis, we identified and targeted investors whose acquisition criteria aligned with the property’s profile. By highlighting CVS as a nationally recognized credit tenant, the stability of the lease structure, and the property’s strategic location, we presented a compelling investment case.

Results

Our targeted approach generated significant interest, leading to multiple competitive offers. This created an advantageous negotiating environment for the sellers, enabling them to secure terms that exceeded their initial expectations. Ultimately, our strategic execution not only maximized exposure but also delivered optimal results, underscoring the value of our international network and market expertise.

Case Study

Expanding Caliber Collision Across the Midwest

Challenge

When Caliber Collision, a nationally recognized automotive repair brand, sought to expand its footprint across the Midwest, the task required a strategic partner who could manage the complexities of ground-up development in multiple markets. Success depended on identifying optimal sites that balanced accessibility, market demand, and compliance with local regulations, while ensuring brand consistency and timely delivery.

Solution

Patrick Reynolds, leveraging his deep expertise in commercial real estate development, spearheaded the entire process with vision and precision. From site selection through final construction, Patrick directed every phase of the project. His meticulous approach ensured that each facility was not only tailored to the unique needs of its community but also met Caliber Collision’s operational and branding standards.

Through careful analysis of market dynamics and regulatory frameworks, Patrick identified prime locations that positioned Caliber Collision for long-term success. His leadership kept projects moving efficiently, overcoming development hurdles and aligning stakeholders, from municipalities to contractors, toward a common goal.

Results

Patrick’s leadership resulted in the successful rollout of multiple Caliber Collision facilities across the Midwest, solidifying the brand’s regional presence and growth trajectory. Each project demonstrated his ability to combine visionary strategy with hands-on execution, ultimately delivering state-of-the-art facilities that strengthened Caliber Collision’s reputation and competitive edge in a highly demanding market.

Case Study

Dollar General Development

Challenge

Expanding a national retail brand like Dollar General into new markets required careful site selection, precise execution, and community alignment. Each project demanded an approach that balanced corporate growth objectives with the unique market dynamics of Oregon and Pennsylvania, where accessibility, visibility, and sustainability were key factors for success.

Solution

Patrick spearheaded both developments, leveraging his expertise in commercial real estate to guide the projects from conception to completion. He conducted in-depth market analyses to identify prime locations with strong consumer demand and convenient access. Working hand-in-hand with architects, contractors, and local officials, Patrick directed every stage of the process, from zoning approvals and site planning to construction oversight and grand openings.

His leadership emphasized both operational efficiency and long-term community value. By integrating sustainable, eco-conscious design features, he ensured each store blended seamlessly into its environment while aligning with regional expectations for responsible development.

Results

Both Oregon and Pennsylvania projects were delivered on time and to the highest standards, creating new retail hubs that supported local economies, provided jobs, and expanded consumer access to affordable goods. Patrick’s strategic vision and meticulous management not only advanced Dollar General’s growth strategy but also left a lasting positive impact on the surrounding communities.

Case Study

Anchoring a Transformative Retail Development

Challenge

The development team needed to secure nationally recognized anchor tenants to establish credibility, drive traffic, and attract a diverse mix of in-line retailers. Beyond leasing, the project also required strategic negotiations and sales of out lots to maximize value and long-term performance.

Solution

Patrick spearheaded the pre-leasing process, leveraging his market expertise and industry relationships to attract Target, Kohl’s, and Lowe’s as anchor tenants. He then broadened the development’s appeal by facilitating negotiations and closing sales of out lots to a variety of end users, balancing the mix between national brands and local businesses. His ability to navigate complex deal structures, align stakeholder interests, and strategically position the development ensured strong tenant diversity and community relevance.

Results

Secured nationally recognized anchors (Target, Kohl’s, Lowe’s), establishing the project as a premier retail destination.

Executed multiple out lot sales, enhancing both revenue and tenant mix.

Elevated the development’s value by creating a thriving environment that attracted in-line tenants and supported long-term growth.

Strengthened Patrick’s reputation as a trusted advisor and respected leader in large-scale retail development.

Case Study

Aligning Brand Vision with Market Opportunity

Challenge

Woodhouse Day Spa sought to expand into a new market but required a location that could embody its brand of luxury, tranquility, and customer-centered experience. Selecting the wrong site risked diluting the brand and missing the target demographic, making site selection a critical success factor.

Solution

Patrick led the site selection process with a meticulous, data-driven approach. He evaluated demographics, traffic flow, accessibility, and the competitive landscape while also considering softer factors such as ambiance and the surrounding environment. His ability to balance financial performance metrics with brand alignment ensured that the chosen site would not only meet business objectives but also enhance the spa’s signature guest experience.

Results

Patrick’s expertise in market analysis and strategic site selection secured the optimal location for Woodhouse Day Spa. The site perfectly aligned with the brand’s vision, positioning the spa for long-term success and growth. The chosen location reinforced the spa’s reputation for excellence, provided a strong platform for customer acquisition, and established a lasting foundation for profitability.

Case Study

Strategic Expansion of Waffle House

Challenge

As Waffle House looked to expand beyond its traditional markets, the brand faced the critical task of identifying locations across the Midwest and South that would sustain long-term success. The challenge was to pinpoint sites that balanced accessibility, visibility, and strong demographic demand, ensuring that each new restaurant would thrive in both established and emerging communities.

Solution

Patrick leveraged his exceptional market expertise and keen eye for opportunity to meticulously hand-select multiple prime sites for Waffle House’s expansion. By analyzing traffic patterns, population growth trends, and competitor positioning, Patrick identified strategic locations that aligned perfectly with the brand’s operational model. His collaborative approach with stakeholders and local communities ensured smooth site acquisition and development, minimizing risk while maximizing growth potential.

Results

Patrick’s site selection efforts played a pivotal role in driving Waffle House’s successful entry into new markets across the Midwest and South. Each location flourished, strengthening the company’s regional footprint and delivering consistent customer traffic. Beyond immediate success, these expansions created a sustainable growth platform, allowing Waffle House to bring its iconic dining experience to hungry patrons while securing long-term brand loyalty in previously untapped areas.

Case Study

Expanding Bibibop into New Markets

Challenge

Bibibop sought to broaden its footprint into new Midwest markets but faced the challenge of identifying prime locations that would ensure strong visibility, customer accessibility, and long-term success. Additionally, the brand needed to secure favorable lease terms to make expansion financially sustainable.

Solution

Patrick leveraged his deep market expertise and meticulous site-selection process to handpick locations that aligned with Bibibop’s brand and growth strategy. He conducted thorough market analyses to pinpoint high-traffic, underserved areas with strong demographic alignment. Beyond site identification, Patrick skillfully negotiated advantageous lease terms, creating a solid financial foundation for the rollout.

Results

Through Patrick’s leadership, Bibibop successfully entered multiple untapped markets across the Midwest. His strategic approach not only accelerated the brand’s expansion but also positioned it for sustained growth, strengthening its presence in the fast-casual dining sector and enhancing long-term profitability.

Case Study

Driving Strategic Expansion of T-Mobile

Challenge

T-Mobile sought to expand its footprint across the South and Midwest, aiming to secure locations that would deliver high visibility, strong customer traffic, and long-term growth potential. The challenge lay in identifying prime real estate opportunities while ensuring favorable lease terms in competitive retail markets.

Solution

Patrick leveraged his deep market expertise to meticulously hand-select multiple sites that aligned with T-Mobile’s expansion strategy. He conducted thorough market analyses to evaluate demographics, traffic patterns, and co-tenancy synergies. Beyond site selection, Patrick played a pivotal role in negotiating lease terms that maximized operational flexibility and long-term profitability for the brand.

Results

Through Patrick’s strategic guidance, T-Mobile successfully established new locations across key regional markets. His ability to pair sharp site selection with skilled negotiations not only strengthened T-Mobile’s presence in the South and Midwest but also positioned the brand for sustainable growth and competitive advantage in these high-demand areas.

Case Study

Market Expansion for Captain D’s

Challenge

Captain D’s, a nationally recognized seafood restaurant chain, set out to accelerate its market expansion with aggressive growth goals. To succeed, the brand needed strategic site selection that balanced customer accessibility, operational efficiency, and long-term profitability. Entering new and competitive markets required not just data, but the expertise to translate it into confident real estate decisions.

Solution

Patrick partnered with Captain D’s as a trusted advisor, bringing his deep expertise in commercial real estate and his nuanced understanding of the restaurant industry. He designed a tailored site selection strategy that analyzed demographics, traffic patterns, and growth potential to identify high-performing locations. By combining analytical rigor with a market-savvy approach, Patrick provided actionable insights and negotiation support that empowered Captain D’s expansion team to make bold yet informed decisions.

Results

With Patrick’s guidance, Captain D’s successfully secured strategic locations that amplified their visibility, captured customer demand, and positioned the brand for sustained profitability. His market-driven approach not only accelerated the chain’s expansion but also strengthened its competitive edge, underscoring Patrick’s reputation for delivering measurable value to clients pursuing ambitious growth strategies.